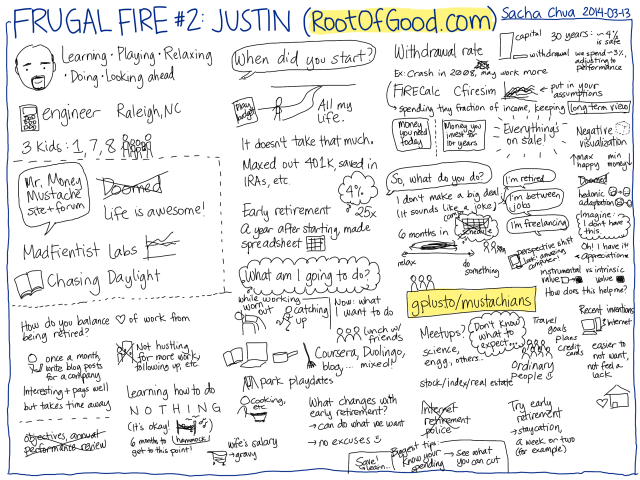

Frugal Fire 002: Justin McCurry (RootOfGood)

Posted: - Modified: | Frugal FIRE, podcastIn this episode, we interviewed Justin McCurry (RootOfGood) about retiring at 33. He's been learning how to relax and enjoy life as a stay-at-home dad, and has mostly gotten the hang of it six months in. =) You can download the MP3 from archive.org

Other resources we mentioned:

- Mr. Money Mustache blog

- MMM: Why we are not really all doomed

- MMM Forum: Life is awesome! Here's why

- Mad Fientist FI Laboratory

- FireCALC

- Google+ page for this event – has some more comments

Join the community on Google+: http://gplus.to/mustachians. For more information about the Frugal Fire show (including how to subscribe to the podcast), check out the Frugal FIRE page. Jordan Read: All right. Welcome everybody to the first official full-length episode of Frugal FIRE. Technically Frugal FIRE #2, because we like numbers. We've got a pretty awesome show in store for you tonight. Here is my co-host Sacha. Sacha Chua: Hello, I'm Sacha Chua! Jordan: We also have Justin from RootofGood. You've probably heard of him on the forums. He's pretty active over there and his blog is awesome. Justin? Justin McCurry: Hey, guys, how is it going? Jordan: All right. We've got a couple of things that we're going to take care of. First of all, some administrative things just to let you guys know exactly what it is that we're doing here, what's going on and what we're planning on talking about for the show this evening. First off, as you may have heard in the primer, the goals of the show are primarily to offer suggestions, challenge your assumptions, offer support to anyone who needs it, have fun time and some motivation. This is for everybody who is attempting to catch FIRE. Once again, that's Financial Independent, Retiring Early like Mr. Justin here. This is a show about frugality, following the Mustachian ways from Mr. Money Mustache. First off, welcome again to the show. I'm Jordan, 28-years-old currently working towards FIRE. My co-host, Sacha. Sacha: Hi. I'm Sacha Chua, I'm 30 and I'm on a five-year experiment with semi-retirement. Jordan: And Justin, who has beat us all to the punch. Justin, would you mind telling us a little bit about yourself? Justin: Sure. I'm Justin McCurry. You can find me at RootofGood.com. I retired at 33 about six months ago. While I was working, I worked as an engineer. My wife, she's been working in banking for quite a while, about the same amount of time as me. I guess it's been an interesting six months so far. I have three children: a one-year-old, a seven-year-old and an eight-year-old. They take up a good bit of my day, but not all of it. I have enough free time to get almost everything I want to do get done. That's my life in a nutshell. I'm here in Raleigh, North Carolina. The sun is finally coming out and the days are getting longer. It was spring yesterday, now it is winter today, and it will be spring again this weekend. I'm looking forward to getting outside and enjoying the weather some more. Jordan: Awesome. Cool, thanks. We're going to touch in base with Justin here in just a minute, ask him how he reached his goals and any advice that he has for those of us who haven't quite done that yet. However, we are going to go over a couple of things real quick just to give you guys an outline of what the show is going to be about. There are a few different things on the Mr. Money Mustache site as well as some stuff that was going on in the forums. A, there was the big thing with Kiss Trust which I imagine a lot of you heard about. Getting a bunch of early retired people angry at you – not a good way to market your product. That's pretty much it. We'll touch a little bit on that, but that's not really our goal. One of the other posts he mentioned, it was something along the lines of things that aren't really all that bad or something like that, which goes in with a couple of forum posts called, “Life is awesome.” I'll talk a little bit about negative visualization and some other things that I have learned while researching Stoicism, which was referred to me of course by Mr. Money Mustache. We're also going to mention the financial independence laboratory from the Mad Fientist. Bunch of little tools and stuff, ways to put in things. Similar to FIRECalc. If you haven't heard of that, it's another nice way of envisioning what your future is going to go. How much do you actually need for retirement, especially if you separate out your money from your happiness. Also do a little bit of a quick book review on the “Chasing Daylight” book which was a book about a gentleman who found out that he only has a little bit of time to live and managed to document that entire thing – his journey from finding out what he did and moving on from there. We're going to ahead and start with a couple of questions for Justin. A little bit more in-depth. Justin, when did you start the whole frugal lifestyle? When did you decide that you wanted to retire early? Justin: I've always been frugal all of my life, really. I didn't know it was called FIRE. I didn't know it was called Financial Independence or Retire Early. I just started realizing… Even back in high school, I put together a little play budget. Before I was thinking about going to college, had a job, I was making $800 a month or whatever it was back then – minimum wage. Not a lot of money but for a kid that hasn't had much money, that's a lot of money. I was like, “Wow! Me and my friends can get an apartment, and split the bills, the water bill, and gas bill, and electricity bill.” I don't know if food is like $100 a month or whatever. Who knows? We can just share a car. I was like, “Wow! It doesn't take that much to get by in life.” So I thought about not going to college. Luckily I had gone to college, but even back then, the concepts were there. Finished college, got a job, and then the money was coming in fast enough and we weren't spending it all. I just starting socking it the way, dropping it all. Maxed up the 41K first year I could. I even had IRAs back with part-time jobs during college. It really didn't start out as a goal to retire early, necessarily, but just saving a lot. I think I found the early retirement – I think it's EarlyRetirement, the early retirement forums. I started reading up there and learning about – there are people that have done this before. There is the 4% rule, and there's figuring out how much you make, and figuring out what you're going to be spending in retirement, and after that, just a simple mathematical formula or equation of saving up enough until you have 25 times your expenses in retirement, and then you're financially independent. Probably somewhere a year or two after I started working full-time after college, that idea of early retirement crystallized in my head, that I had a spreadsheet, I could figure it out. Jordan: Awesome. Cool. You've essentially been frugal your entire life, similar to Sacha. You haven't made the same dumb mistakes that I have and stuff. After you retire, a lot of times people have questions like, “I couldn't retire. I love my work. What am I going to do with all of that time honestly? How am I going to handle this? Right now I decompress for an hour. I don't know that I could fill up my time.” Now I know you said you have kids and that takes a pretty good chunk of time out of your day. Besides that, what kind of personal goals do you have? What kind of tasks do you do to fill your days? Do you find that that's actually an issue? Is it something that people need to start thinking about before they catch FIRE, before they start on this path? Or is this something that you've done and it naturally kind of fills things up as you go? Justin: I've never had enough time to do everything that I wanted to do. When I was working, you have an hour or two each night after work, maybe after you have dinner and before bed. You're just so worn out mentally from work that you're not able to just sit back and relax. There's the weekend when you're working, but the weekends are so filled up with catching up from the week, catching up on what you've been wanting to do, catching up on chores, running errands. You always hit Sunday night, you're like, “Man! There's so much I wanted to do but I didn't get it all done. I didn't get half of it done.” Now I don't have Sunday nights anymore. I just have all this relatively free time. There's kids stuff in there, but for the most part I just do a lot more of what I wanted to do when I was working. I would end up with all kinds of stuff. I read books. In a typical day I might read a book for an hour. I might get on the Internet and mess around for an hour, or two, or three. I'll play some online games with some friends that might take 30 minutes or an hour. I'll cook dinner, cook lunch, do a little bit of work around the house, do some yard work. When it's spring time, I'll do some yard work. In the winter, there's not really anything to be done outside. I've been doing some online learning. There's a course I've been working on. There's the Duolingo French language learning. I've been learning quite a bit. Sometimes I'll spend a couple of hours–three or four hours sometimes–writing a blog article, doing research for it. It's really just a very mixed bag of what I'm doing. And then there's the social part. There's the relaxing part. Go out for lunch with some old friends, take my one-year-old out on a play date with a friend of ours, or go to the park just hang out, bum around. I guess there's not anything big, major milestones I'm trying to hit right now today. Just enjoying life each day. Jordan: Awesome. That really is what this is all about. Money buys you freedom, it doesn't buy your stuff. It can, but if you waste all your time on stuff, you'll never be free – never be free of that employer, never be free of that jerk boss, never be free of those stupid office functions, etc. I'm glad you mentioned the social things. We actually started this Google+ community called Mustachians. Sacha, in a minute here will get it up on the board for us so you guys can stop by, join in, and everything. One of the big things that I guess the goal of this or the reason that I created this was because people have – they really like to meet up with other people and have in real life hangouts. That's one of the things that we try to create. You can see the link right there, Gplus.to/mustachians. I know you've had experience, Justin, with Mustachian meetups. Can you tell us what that was like? Where was it? When was it? What was it like meeting a bunch of other people who are either on this path, that are already retired, or whatever. Can you just describe that a bit? Justin: Going into it, I wasn't really sure what to expect. I think we had the first on in October of 2013 here in Raleigh. I was meeting five unknown strangers from the Internet. Got a little bit of apprehension. We were meeting in a public place out in the open. I had my wife there for backup. I was relatively comfortable. I knew the area. It was cool. But once we got there, we were actually a few minutes late, and they were all there hanging out already. It was just five or six ordinary people. I think they all live in Durham. I live in Raleigh. We're 20-30 miles apart but I can see us hanging out like we knew each other, grew up together, or went to college together. A lot of science/engineering people there, very smart people, fun to chit-chat with. About half of us were stock market index fund investors, maybe one or two guys were real estate, mutual income guys. Some diversity there. We just shot the breeze about travel, goals, plans where we're at – jobs, credit card hacking. It's fun to hang out and be among company that knows the acronyms, knows the lingo and gets it so you don't have to try to dance around the issue of “Is it even possible?” or “That's totally crazy.” I don't really talk about financial independence with my friends that much in general, just because it's not necessarily something that they are very, very laser-focused on. Sacha: How do you manage that? You've mentioned in our pre-interview that you just see a lot of other stay-at-home dads, or stay-at-home parents, and this is something that people understand fairly well. But this early retirement idea on the other hand is something that a lot of people are uncomfortable with. They don't think it's possible. It might not be something you talk about with friends, but how do you deal with it when you're socializing with other people? When they ask the “So, what do you do?” sort of question? Justin: It's interesting. I've seen very different takes on how you present it and I kind of just don't make it a big deal. I think I've mentioned to one or two people, “I'm retired.” I don't know, maybe I look a little bit older than 33, maybe I look 40 or something, so they're just kind of like, “Oh, maybe he's a dot-com millionaire or maybe he's just BS-ing.” I joke around a lot too, so it's easy to mistake what I'm saying as just a joke. For a lot of people I don't even bring it up. If they say, “Oh, that's nice. You have lots of free time.” Then I can just say, “I'm just not really busy right now” or, “I'm in between jobs” which is sort of true. There's a job on one side of this break, not on the other side hopefully. I did do one freelance job so I can say honestly that I do a little freelancing on the side. I haven't done anything for months. It's maybe a little bit misleading. Overall I haven't really seen any backlash from it. I know some people are just extremely scared to ever mention that they're retired early. I have never been called on it or asked to explain it. I'm only six months into it though. Jordan: Got you. That does brings me up to another question. I know that we talked about this a little bit in the pre-interview and everything, and I know that when I catch FIRE, I'm going to have this issue. I love my [inaudible 0:16:41], I love my job, I love doing what I do. For those of you who don't know, I'm a software engineer, I write code, I make magic happen everyday. I imagine I'm going to take some freelance jobs, or some contracts, or something like that. How do you balance that with being able to step back and be, “I don't necessarily have to do this.” How do you separate work from being retired? Justin: I don't really know. It hasn't really been an issue with me so far. I have this relationship with a company where they said, “Maybe once per month you can write a blog article for us.” The pay was just very good for what the market is out there for freelance writing. I said, “Okay, cool. Sounds interesting.” It's for a good company that I know and that I like the product. I'll give it a shot and we'll see where it goes from there. That’s really presented as maybe do once a month for three months. I think it was probably 8-12 hours total for that first job. I haven't been knocking on his door saying, “Hey, can I please have more work?” If he called me today, or tomorrow, or emailed me, I probably would do one. If it interferes with your life, you don't have to do it. I think I sent you guys the job offer for some contract work doing some podcasting and kind of stuff for something. I was looking at it, I was like, “I can probably figure this out and BS my way in this job, make some hundred bucks or $500 a month.” Whatever it was. But then I was like, “Then I have to learn it, I have to figure it out, and then manage it, and then it may blow up or double the amount of work.” That's one of those things where I was like, “That's too involved.” I just don't want to do it. If something comes up that's interesting and then it also happens to pay well, I do it. But I just didn't want to commit to too much. It was a little bit stressful when I was doing that freelance article because I did have to make some corrections at nine o'clock at night – which I don't mind, being flexible. It took time away from what I wanted to do. That's something I would keep in mind in the future. If it does interfere with what I want to do and I don't need the money, then the right thing for me to say, “Hey, thanks, but I've had enough.” Jordan: Haven't you had to do that before or is it just that you've kind of set yourself up to where you look at the options more often than you really want where you don't need to turn it down? Justin: Pretty much. It's has just been that one thing I've done so far. I'll do more for the company probably. I'm sure people who make freelance writing or blogging a career, they're probably a lot more active and following up, doing the right things for business – following up, reaching out, making contacts and say, “Hey, here is an idea. I can write about this. I can write about that.” “Hey, do you have anything for me this week?” Making those contacts once a week, twice a week. I still talk to the guy fairly often but it's not really about doing more work. I think it's just the difference of are you out there piling the pavement trying to get more work? If you're doing that, that's the business. There's nothing wrong with doing that. The good thing is I can do as little or as much as I want. I just don't have to because of the money situation. Jordan: Awesome. Sacha, I know that you had some experience with that. Did you want to discuss that now or maybe during the panel section? Sacha: Actually what I'm particularly curious about is not so much the chasing after work but something I read in your sixth month update where you were just trying to get used to being able to relax. Is that what I'm correctly reading from your blog post? Where in terms of relaxing, you have to learn how to give yourself permission to just read a book during a weekday, or go for a nice long walk when other people are still working. Tell us a little bit more about learning how to do that. Justin: Yes. It sounds weird, learning how to relax or learning how to do nothing. I guess since I was in middle school, or high school, or whatever, I've just been busy all the time with school, or with work, or with both, or other activities, and kids. It's hard to realize that it's okay just to sit down and do nothing for three hours. Like lying in the hammock for three hours. Just watch the birds fly around, watch the woodpeckers peck a way and see if you can see how many squirrels you can count. Nothing productive. Read a book, whatever, listen to music. I think it was last month, I was able to finally just kind of relax and say, “This is it. I don't have to do anything I don't want to do anymore. I don't have to always be productive.” I just felt like I had to be busy the first few months and I've heard it takes six months to two years to kind of unwind and get into this new groove of early retirement. I think I sort of reached that point now. It's hard to explain. Just accepting the fact that it's okay to not always be productive. Sacha: Yes. I remember struggling with that myself in the first couple of years. It's just like, “Wait, I should be doing something.” Otherwise, what else will we have to show for the day? But you're learning a lot. You're learning French, you're learning all sorts of things, you're teaching your kids stuff, too. I think you're actually doing plenty when you say you're doing nothing. Justin: Yes. That's part of it. I feel like I have to have like objective measures of performance. Like I had to fill out an annual performance review or something. I don't. It's up to me, I'm responsible for me now. That sort of getting comfortable with that. There is no external party other than your own family and taking care of them like I should with finances, the books, balance and everything. But it's okay to have some “me” time, or play with the kids, go outside and play, play a board game with the kids, spend three hours cooking something elaborate even though you can be using the time to do something else – writing a new freelance article for some money. Jordan: Cool. What is different? This is something that I know Mr. Money Mustache really recommends and I totally get the point of it. Kids for me aren't necessarily in the cards. But what does it like being a retired stay-at-home dad versus like a regular stay-at-home dad? How would you describe the differences there and how do you deal with that stuff? Justin: I'm not really sure. I don't really know qualitatively how it's different other than we have plenty of money. I know a lot of single income families struggle with that in terms of – you have plenty of money to put on the table but you may not have enough money to do whatever you want to do. I think we're at that point where my wife is actually still working for another year, year and-a-half maybe. But that's just gravy. It's just icing on the cake. Her salary has been sitting in the cash account, it's been building up and I haven't really figured out what to do with it. We almost have – I don't know, it's probably getting close to a half a year or a year's worth of expenses now just in cash. It is weird because I'm here by myself all day so I am like a stay-at-home dad. I've used that description before. I'm comfortable with it, I don't feel like I have to have an early retirement card at my back pocket. I think I've mentioned the “Retirement police” article from Mr. Money Mustache a couple of times with my blog because when I read that, it resonated so much because who cares? It's just a label. Whether you're early retired or a stay-at-home with – I got withdrawal rates at 3% or so. Are we financially independent? Yes. Can my wife quit tomorrow? Yes, she might if she has a bad day, that may be it. Not a big deal. Her company is very flexible right now and offering in some pretty good stuff to keep her around for a little while. I guess I can't really say there's any difference between stay-at-home dad and early retired stay-at-home dad other than the financial independence aspect of it. Jordan: Awesome. Sacha, did you have any other questions before we jump into the panel section of this? Sacha: For sure. We'll come up with other questions as we go through the conversation. So, go ahead. Jordan: All right, awesome. One thing that I did want to point out and Sacha is the expert on this. You can actually see it at her blog. What you're seeing on the screen right now and her stuff pops up is – what is it called? Visual note-taking? Sacha: It's just a way for us to remember what we've been talking about and it's something that's easy to share with people afterwards, too. Jordan: And she's got a really good blog post about how to go about doing this, if you guys were curious what that was. It wasn't just her with some type of doodling. That's awesome. There were a couple of things that were mentioned that some of our newer viewers or people new to the FIRE thing may not be familiar with. We'll just go ahead and start with you Justin. Can you explain to people what you mean or what is the withdrawal rate? What does that mean exactly? Justin: There is a study. It's called the “Trinity study.” I forget who the authors of the study were but they basically studied how much can you withdraw from your investment portfolio so that it will never ran out of money. They looked at a 30-year period and they said, “You can withdraw around 4% of your portfolio each year and adjust it upwards for inflation every year, and you will not run out of money 95% of the time.” Five percent of the time you ran out of money and I don't know what you do. I guess you go back to work. Jordan: Take a freelance job. Justin: Exactly. That's it. The key parts of that are it's only 30 years. So if you're retiring in your 30's, that would only get you to your 60's. Now, Social Security kicks in in your 60's and you're maybe totally fine anyway. I look at 4% and I said, “Well, there's a little bit of risk there for me.” We just spend what we want to spend, and it ends up being about 3%. It may be more as the kids get older in their teen years. It may come closer to 4%. The portfolio may make another [inaudible] and will be closer to 4%. But the one thing that we plan on doing is adjusting our withdrawals when the portfolio fluctuates in value. We're not going to just blindly keep spending 3% or 4% of our portfolio every year if the portfolio falls in half like it did in 2008 and then in 2009. We'll probably cut out discretionary spending. I might try to pick up some more freelance work, pound the pavement and try to bring in some money from that a lot harder. That's something that you're looking at. I think 4% is a good easy rule, it's a good sound bite. “Hey, you can spend 4% of your portfolio every year.” It's an easy rule-of-thumb and you can really model it exactly for what you plan on spending and you can play with Social Security when you're planning on getting it or other pensions. A lot of people still have pensions especially in the government employment sector. You can model that, there's FIRECalc.org and there's another one called CFIRESim.com or CFIRESim.org. Those two are pretty similar but use that same Trinity study methodology and data. They're good to play with because you can figure out: do you want 4% inflation adjusted every year and that security of knowing you'll never have to cut your spending ever? For me it seems unrealistic to think that you're going to spend the same amount whether you have double your portfolio value in 10 years or if you have half your portfolio values in 10 years. I think naturally you're going to feel stressed of spending less money. If your portfolio gets cut in half, you're going to spend less money; if you're twice as wealthy as you are when you first retire, you're probably going to spend more money. Sacha: Tell me a little bit about surviving that stressful period when you saw your portfolio go down quite a lot in 2008. How do you keep on going? Justin: It really was not that big of a deal. I don't know how much we lost in total but it was almost $300,000. It was a lot of money at the time. Multiples of our annual income. But we were spending a very small fraction of our total income – probably about 40% of our income, we were spending and we were saving the rest. We knew at the time if one of us lost the job, it really would not matter at all in terms of day-to-day living. It would just mean we're saving less money. That's part of the reason why we knew the investments were there for five or six decades. We don't need the money tomorrow, we don't need it next month, or next year, or even 10 years from now. It's long term. If you can separate the psychology of losing money today that you need today from having the values fluctuate for something that's there for the long term, that will keep you sane and lets you stay in the market when you need to be in there and prevents you from sailing out at the bottom. I know people I've worked with and people online who were just freaking out and panicking as the market kept dropping and a lot of people sold and they did not get back in – and still aren't in, a lot of them – and they just went off investing in the market. Long term, I don't see where the wealth creations didn't come from and investment portfolio without some good allocation to equities. Unless you just have tons of money and you don't need more than 1% or 2% per year to spend for your portfolio. Jordan: Got you. Okay. What's the phrase that we use around there when the market drops? “Everything is on sale!” Justin: Yes. It's a buying opportunity. Jordan: Absolutely correct. Pulling out at that point is too late, you hang on. Justin: Yes. Jordan: Cool. One of the things I did want to discuss here in general is about – we're going to just change gears just a little bit – negative visualization. It's about the Stoic philosophy or part of the Stoic philosophy from the ancient Greek Romans. Marcus Aurelius was one of the last famous Stoics. However, Mustachianism has been linked relatively well to Stoicism minus some things that aren't necessarily the same. But it's essentially the philosophy of life. One of the things that I've found that was extremely helpful with that is – well, Mustachianism is all about separating out, it's getting the most out of life without tying that to money. Yes an all-inclusive vacation would be really fun and it cost a whole bunch of money. Yes, camping is also very fun and cost a lot less money. The Mustachian, the way of life essentially is all about finding those things that get the maximum happiness for the least amount of money. You're not depriving yourself of anything, you're just finding alternate ways of looking at life and everything like that. One thing that I wanted to share was – and it tied in really well with “Why we're not really all-doomed” blog post from Mr. Money Mustache – that is just understanding exactly it is what you have and how awesome it is. I started a thread called, “Life is awesome – here is why.” And I just kind of wanted to share this with our viewers because I think everybody should try it. It does change things. You may or may not have heard about hedonic adaptation. It was a result of a study that was done that followed two people, newly injured paraplegic and a lotto winner. These people's lives change a lot very quickly right around the time of the study. Obviously the paraplegic was a little bit down and obviously the lotto winner was a little bit up. But what they found is that after about six months max – some of them happen sooner, other times it has happened, I'll touch later – but they adapt and their level of happiness is about the same that it was before that. That is just the human mind, the human brain has a tendency to get used to things. It's not necessarily a bad thing with survival instincts. Something has been around for a while, chances are it's not probably going to eat you. In any way there's not too much brain power running about that log near you that just appeared. Unless it turns out to be an alligator. However, the issue with that is the [inaudible 0:36:58] consumer driven keeping up with the Joneses of society. That hedonic adaptation essentially indicates that we need to go out every couple of months and get new stuff to make us happy. Negative visualization is a practice in which a couple of times a day, a couple of times a week, however you often want to do it, you imagine what life would be like without something that you currently have. “My life is awesome” thread started off with, “Close your eyes. Look at something around you. Close your eyes, imagine it's not there. What would life be like? Now, open your eyes, it's there. Life is awesome.” What it's all about is just understanding that these things don't necessarily make you happy. The truest point of stoicism or mustachianism really, that was just a fun little play on it that I started because I think it would be a fun little adventure for people to partake in. However, it's all about just understanding that stuff isn't what makes you happy. Freedom, adventures, memories, that's what makes you happy. Justin, why don't you tell us a little bit about if you have adjusted or if you've always been that way. What kind of things you do that kind of challenge that assumption and you realized, “Oh my goodness! I get so much joy out of doing this instead of this.” Justin: Yes. I guess to kind of continue on that thought process of appreciating what you have, or understanding what you have and why is it useful or valuable. I took a class back in college. I forgot what it was called but I think technology, and science, and ethics, and engineering, and something rather but one of the subjects or topics of discussion was instrumental value versus intrinsic value. I don't know if you've heard those two computing concepts but just basically, you got to think that things are instrumentally-valuable. Do things bring you value because of the way that you can use them or what they bring about? Or are some things intrinsically-valuable? Are they valuable in it of themselves? Instrumental with the means to the end and intrinsic is the end itself valuable. I just look at so many physical things, possessions, and by and large, they're instrumentally valuable. I like to read books. Books are interesting and they're fun, but they're instrumentally valuable. They have no value unless you read them or enjoy them. The same thing with vacation house, or a boat, or a nice car. Almost everything that we enjoy is instrumentally valuable because of how we use it or what we do with it. I keep that in mind. I haven't really done that explicitly, those negative visualization exercises of, “It was gone! Yes I would miss it, that would suck. Oh there it is, great! I'm happy now.” I do think about things like that and like, “Wow, this smartphone is amazing.” Ten years ago, this didn't exist. This is like a computer. I can put it in my pocket and it has six or eight-hour battery life and it is connected all the time. Mine happens to be free with FreedomPop. I bought it for $50 off of eBay. A couple of hours of my former hourly rate of earnings for this amazing device and it's a camera. I can take pictures with it. I can take pictures of my kids and share it with other people, record video. This is amazing piece of technology. But it's instrumentally valuable. It lets me communicate, it lets me read on the go, communicate on the go. I'm always focused on how does this thing help me or what benefit does it bring to me? “Is a $500 phone 10 times better than a $50 phone?” I usually end up saying, “Not really.” It may be a little bit thinner, maybe a little bit brighter, or have more pixels for inch but I don't really care. I just want to be able to read my email or send an email whenever I want to, and use the GPS if I want to figure out how to go somewhere, or if I'm meeting a friend, give him a phone call or send him an email and let him know. Those are the sort of things, just like the smallest things like a phone is pretty amazing and part of it is – my daughter was she was sick at home, wasn't able to go to school over the week. So we were going over some of these recent inventions. She'll mention something and then not realize that there was a previous technology before that but didn't exist when I was a kid. I was going over the Internet. The first time I used it was in high school. You guys are probably couple of years younger than me so you may remember you're in middle school using the Internet. But for her, everything is connected, everything is wired up, it works, technology is so cheap, and often times free, and you don't have Windows 3.1. We have Windows 8.1, or Mac, or whatever OS it is now, or iPhone, or Android. We have a diverse choice of operating system, we have diverse choice of environment and by in large they talk to each other. They communicate, you can do what we're doing right now, sit down and chit-chat on the Internet, on a few hundred-dollar laptop, and you're halfway across the country and then Sacha's way up north from here in a different country. I'm just marveled at all these different amazing technologies and advances that we have even in the last 10 or 20 years. I guess it makes it easier to not have everything because we're never going to have everything. We already have everything, really. We already have so much stuff compared to our former selves 20 years ago, or our parents, or people in other countries. It doesn't cost that much to have a pretty rich life and enjoy things that are relatively inexpensive, or almost free, or sometimes free. Jordan: Got you. I actually realized that you and Sacha are probably the worst people to ask about this. You guys have been frugal your entire life. “What do you mean struggle with this? Are you high?” What about you, Sacha? I would like to ask you. How do you separate yourself from keeping up with the jounces or how do you separate yourself from wanting more, and more, and more, and just being satisfied and even stoked about what you have? Sacha: Amusingly enough, part of it I guess was growing up in a family that was doing a lot of advertising photography. Watching my dad shoot pictures of french fries, or clothes, or cars, or whatever, and seeing the kinds of things that people did to encourage people to want things – that made me realize, you can think about these thinks critically and you can say, “How does this help me? No, it actually doesn't help me very much. I'd rather spend my time, and money, and interest, and attention in other things.” That helped me a lot. I'm just realizing I don't have to accept the messages that I hear from other people and actually, I really enjoy simple stuff. For example, travel is such a big thing in the early retirement community people, dreaming about being able to retire in order to travel – I actually really like being at home. It's thinking about what it is that you're accepting to your life and realizing that you can't buy happiness. You don't go looking for it outside yourself. You just organize your life to being able to enjoy it. Jordan: Got you. Justin: Sacha, you mentioned that you enjoy being at home. I'm kind of the same way. I don't know if that is an indicator for frugality or going to be successful in early retirement or what. We certainly done staycations before where we're just like, “Let's just hang out and do stuff around the house. Let's go see the museum here in town we've never been to before. It's free and it's four miles away.” And we've spent 20 years never going to this awesome museum. We've done that before. It's weird. I know what you mean. There are certain people that plan on doing these huge massive trips. I'm kind of guilty of it as well. Sacha and I were discussing before the show. I was getting tips on things to do in Toronto and how to get around. But that is one thing we do, plan on doing some longer travel – not just the weekends away, or a week, or rushing from site, to site, to site to see things. But I think if you ever want to try out early retirement, just take a week or two off and do a staycation and see how bored you get. Because if you get bored in a week or two, you might as well just keep working forever so you have something to do. Sacha: No. We don't want to discourage people right away. It took you six months to figure out how to relax. It will take people more than a week. Justin: I'm still waiting to be bored. I don't know. I'm waiting for that time where I'm just like tooling my thumbs and realizing that there's nothing else for me to do out there. I've surfed the entire Internet and I've watched everything on TV, and I've read every book out there and I've learned every language. This realistically is never going to happen because knowledge and content is being created faster than I can absorb it. But I think maybe a week or two off, or maybe even a sabbatical, or like you're doing five years off, at some point, if you get bored easily in a weekend, or in a week, I don't know – I think that might be a good trial run to at least figure out is it something that you enjoy, or do you have to have something just busy work, just something to do? I'm not saying busy work, it could be like Jordan loves to program and write software, write code, but do you have to do that 40 hours a week or more? How can you keep busy? How engaged can you be and can you find something to keep your mind engaged and keep your interest? Sacha: Actually I want to pick up a point from that because I think a lot of people struggle with figuring out the answer to the, “What am I going to do?” question. People are used to getting direction from other people, they're used to having projects to work on, objectives to work towards. Sometimes people have burned through their initial backlog of tasks, all the chores they've been meaning to do around the house, or all the little projects that they thought they wanted to do. Now that you have practically unlimited time, you're retired early, you've got some time to explore your other interests, you might still find that you struggle to come up with projects – actually you seem to be doing fine with that part – but there's still projects that you make slow progress on, or these little projects that you might get around to but not yet. People, if they try staycation for a week or two, it takes time to learn how to decide, “What am I going to do today? What do I want to do? How do I want to organize so that I do the stuff that I care about, I get other stuff done as well?” It's a skill. Or is that just something I struggle with and you don't? Justin: I thought about it and thought about what's the best way to make the best use possible of my time and there's this dynamic between, “It's okay to do nothing.” And then there's the competing interest of, “Yes, but I don't want to be nothing forever. I don't want to wake up in two years and realize that I've just spent two years doing nothing.” That's why I struggle with it because I want to do something kind of productive and not just waste my time because this is the rest of my life. This is it. I saw somebody have a blog post about a very fixed rigid schedule like, “Monday, I'm going to get up and I'm going to workout from 7am to 8am and then come back at 8:15am to 9:15am, I'm going to clean the house. 9:15am to 10:15am, I'm going to sit down and read a book. Then 10:15am to 11:15am, I'm going to prepare lunch. At 11:30am I'm going to have lunch. I have free time from 1pm to 3pm.” Then that's repeated the whole week and there's four hours of unstructured free time in the whole week. I thought about that and I was like, “That seems pretty cool. No, I don't think so.” I don't know, I guess I'm comfortable enough where I don't want a fixed schedule like that. I could see the appeal if you're just sitting around doing nothing and you feel like you're just unproductive and you're not going to enjoy your time. I could see the benefit of that to remind you consciously like, “Oh, it's 11am, it's time to go out for my tennis lessons right now.” Or, “I'm going to go around walk around neighborhood. It's 1pm and I'm going to go out for an hour long walk, maybe see some neighbors.” I could see the benefit of a rigid structured schedule but I guess I have a little bit of that with the kids, and walking to and from school with them, and taking care of the one-year-old. I do have that kind of built-in to my schedule already. As part of it, for me I know my life will be different in three and-a-half years or so where this kid is in school all day and then I have just from 9am until 3pm, I have this six-hour blog like, “What do I do all day?” I could almost drive from here to the beach for a couple of hours. I would never do that because I'll not drive four hours to spend two hours at the beach. But I could go downtown and bum around four or five hours. I may do that. I may do that with the kiddo once it gets warmer. Anyway, the schedule was an interesting thing I saw and that could help some people if they need that rigidity of a schedule or structure in their day. It's almost like summer camp in a way, where you have programmed activities and you know what you're doing Tuesday, or Wednesday, or Thursday, or whatever. So far I feel pretty good. I had a little bit like there are certain things at the community center and the library that I do with the one-year-old on Tuesdays for example. I know I'm doing that but otherwise, my Monday, or Wednesday, or Thursday, or Friday are pretty free. Sacha: Yes. The way I handle it is I come up with list of these things that I do want to work on, the productive part of the “do something.” Then I treat it like a buffet. Whenever I feel like working on one of those projects, I go ahead and do that. The difference there is that this experiment, the semi retirement or early retirement means that I get to choose what I want to work on, or what I just want to spend a couple of hours reading a book, or watching movies or whatever else, going for a long walk. The choices are incredibly enjoyable. Justin: If I ever get this feeling of like, “Wow! What should I do now?” Then I have a list of things that I want to do, that I have to work on. I'll just go look at it and say, “All right, which one will I pick today?” Like a buffet, “Which one do I want now? Okay, I'll choose this one. I haven't done my taxes yet. I have to do taxes.” That's going to be eight hours maybe of putting everything together, checking the numbers, filling out forms, putting stamps on the envelope.” That's something if I'm ever bored. I have eight hours that I have to do between now and April 15. There's no excuse for me to be bored unless I finish that thing that I have to do some time in the next month. There are so many things in life that you just have to get done. We're trying to get passports for our kid right now and dealing with the incredible bureaucracy of getting a passport through the postal service done here is mind-boggling, that it's so hard. Yet we pay them for the privilege of not being able to talk to them, waiting in line, them not showing up – anyway, it's nice that we have the time to be able to pursue this and get it. But at the same time, I still feel like it's a waste of time when I'm not able to just get something done quickly. Sacha: But so, retirement leaves you no excuses. You will get it done and at least you'll get the power through all of the things that you need to do and the things that you want to do. Okay, we've got about three minutes before we start the open hangout. If you were to share a tip with somebody who is just starting out this journey for example, what type of action that you would encourage them to take in order to get them moving towards frugal FIRE? Justin: I guess maybe two things. Just figure out what you're spending first and then maybe figure out if you can cut anything from it. Because there are two ingredients to being able to FIRE at a very young age. That's keeping your expenses low and then saving lots of money. Obviously knowing what you're spending is one of them. The other one is just start saving money. Even if it's just putting it into a money market account until you figure out how to invest or where to put it. I know where to put it because I've been doing it for 10 years and I've read a lot of books on it. But whether it's a 41K, or an IRA, or just putting in a money market account, it's better to save it now when you have it instead of spending it. Then get educated on where should you put the money to be as optimal as possible. That way, once you do figured out, “Hey, you have this pot of money. You can actually go ahead and invest it.” That's probably the two biggest tips. Know what you're spending and go ahead and start saving now. Jordan: All right, cool. I can actually take that. One of the things that we're planning on doing on the show is a challenge for our watchers, listeners, readers, whatever it is that you are doing with this video. Here is your challenge for the week. This will go for those of you who have got FIRE, those have just heard about this or they still think that catching FIRE is not a good thing. Here is your challenge: by two weeks from today, I would like you to have something set up, whether it's Mint, Personal Capital, GNUcash, anything like that where you track your spending. I want you to take that, track it for the next two weeks. Figure out what your savings rate is and increase it by two percentage points. I'll teach you guys on how I did with that because I'm going to do the same thing, and yes, thank you all for coming. Justin, thank you for being our first guest ever. Man, you are awesome, I appreciate it. Justin: Thank you. Jordan: Sacha, once again the awesome notes, thank you so much for doing that. Justin, if you want to plug your stuff real quick. Justin: Yes. Stop on by the blog RootOfGood.com, check out what we got going on. Under “links” at the top or “categories”, there's a link for all posts if you want to see everything since the beginning of time. I think Mr. Money Mustache has a very similar layout. Check that out. There's a bunch of stuff on there about our budget, how we save on taxes, how we're doing on each month financially with spending and saving, [inaudible 1:00:01] retirement. There's a new post every once in a while, check it out, subscribe, I'm on Facebook, I'm on Twitter. Check it out, RootOfGood.com. Jordan: Awesome, thanks. Sacha? Sacha: And if you want to join the community, go check us out at Gplus.to/mustachians. Jordan: All right. I'm Jordan from JordanRead.com, mostly on G+ though. I'm not very good at blogging because I do have a job still. I'm not there yet. Sacha? Sacha: I'm at Sachachua.com. Also, you can find it at LivingAnAwesomeLife.com if you find my name hard to spell. We'll see you soon. Catch us in two weeks, I guess, with our next guest! Jordan: Thank you guys. Justin: Thank you.

Podcast: Play in new window | Download

Subscribe: RSS