Following up on my Accelerated Learning chat with Timothy Kenny, where someone asked how I made the decision to go on this 5-year experiment with semi-retirement:

Following up on my Accelerated Learning chat with Timothy Kenny, where someone asked how I made the decision to go on this 5-year experiment with semi-retirement:

It might surprise you, but I consider myself pretty risk-averse. I don’t bungee jump. I don’t ski. I don’t even drive. I spend hours and days analyzing decisions. I make contingency plans. I take small steps.

So, how does someone like me end up taking a left turn away from a promising career (great ratings, wonderful opportunities) for a 5-year gap in employment as an experiment with semi-retirement?

I’d been thinking about something like that ever since I started working. I knew I wanted to learn about starting businesses someday. My parents built their own advertising photography studio, and although they worked long hours, they were happy. I grew up reading books about management and accounting—ever since I was tall enough to pull them off my mom’s bookshelf.

When I graduated with my master’s degree and started working, I consciously resisted the pull of lifestyle inflation. My expenses were much like the one I had as a student: I rarely ate out, and I bought my clothes on sale and second-hand. An excellent public library meant I could keep my book and entertainment budget under control.

I was excited by the idea of being able to finally apply the advice I’d read in personal finance books. I maxed out my Registered Retirement Savings Plan contributions and put a tidy amount away for other long-term investments. I knew my tendency was to scrimp and save, so I also made room in my budget for two things: a play fund, and an opportunity fund. The opportunity fund would be for learning how to make better decisions and take better risks.

Many of the decisions I made with the opportunity fund paid off, encouraging me to try more. I bought a tablet, and then a tablet PC. I bought books, went to events, tried out stuff, treated people to lunch so that I could pick their brain. As I gained confidence, I wondered: how can I make the opportunity fund even more liberating?

I redoubled my focus on saving, channeling more into the opportunity fund. I looked at my expenses, too. I’d been tracking my finances since 2005, so I had a good idea of how much I spent on average. I started learning more about businesses. I came across the statistic that ~80% of businesses fail within the first five years. If I could free myself from worrying about cashflow for five years, I’d probably do all right – and even if I messed up and had little to show for it, I’d still be doing about average. If I totally messed up? Well, I’d probably still be ahead of where I should be at my age.

Besides, I hadn’t read about a lot of other people giving this kind of experiment a try. If I could muster the time, space, and guts, I might as well learn what I could with the opportunity.

It was not an easy decision. I knew many people who were struggling to find work, or who were unhappy with the work that they had. Technology companies tend to discriminate against older people. Would I waste the prime years for building an amazing career? Would I find it difficult to re-enter the workforce if I wanted or needed to, such as if something happened to W- and we needed a steady income?

I talked to W- again and again, threshing out the possibilities and risks. W- supported the idea. It made sense to try this out, and this was as good a time as any to do so. We didn’t rely on my income for mortgage payments or other constraints. We have a decent public healthcare system, and he had extended health benefits through IBM. We didn’t have any young kids or sick family members who needed care. It was better to learn now than to wait until I had to.

The bigger risk would be to not learn how to create value on my own. If I could learn how to make stuff that other people found valuable, if I could learn how to use my time and energy even more effectively—to learn, share, and scale up—then I could help W- learn these things if his situation changed. And it would probably change someday, so it’s better to prepare for that.

What were the real risks, anyway? I have a lot of fun learning and tinkering. I figured I’d be able to keep my technical skills sharp, and maybe I might even pick up a few other marketable skills along the way.

Sure, the employment gap might turn off some employers. Some of my freelancing friends were going through rough patches, and they told me how employers looked at them askance (“Is this guy going to take off and start his own company again in a couple of years?”) I figured that if I really needed to re-enter the workforce, I could probably come up with a coherent story for these five years. I knew I’d take notes along the way, and I had a lot of practise using weekly reviews to remember what I learned or accomplished. The brain is excellent at rationalization, and I’m sure that in 2017, I’ll be able to explain my experiment in a way that makes sense.

One of the lessons I learned as a teenager was not to get paralyzed by the thought of my “potential”. Sure, if I leaned in with all I had, I might reach the corporate or entrepreneurial stratosphere. But really, I don’t need that much. I just need enough, and enough can be incredibly liberating.

My opportunity fund approached my 5-year target, and I firmed up my plans. I considered ratcheting down work: maybe 75% part time, then 50% part time, then 25% part time, then fully “retired”. With IBM’s intellectual property agreements, it was easier to just make a clean cut. (I ended up doing the ratcheting-down with consulting anyway… funny how life works!)

At the one-one-one meeting with my manager where he shared the results of my annual performance review (yay, top ratings!), I told him I was planning to leave the company and experiment with other things I wanted to learn. Since I gave a few months’ notice, we had plenty of time to cleanly wrap up projects. And then I was off on my own.

This experiment gets less and less scary the more I get into it. Sometimes I look at my numbers and wonder whether I can actually take bigger risks than I currently feel comfortable with. I’m getting better at thinking my way through decisions with greater uncertainty or impact, turning to research, role models, and reflection to get myself through it.

If you’re thinking about making a similar decision yourself, these tips might help:

Think about the real risks you’re worrying about. How can you mitigate them? What are the worst-case scenarios, and how can you work around them?

How can you create a safety net for yourself? What can you do to build your confidence and rescue you from some of those worst-case scenarios?

What are some small steps you can try? I didn’t jump straight into semi-retirement. I started by taking smaller risks and learning from them.

Even now, I take very few risks: I overpay my taxes in order to minimize the impact of calculation errors, I don’t claim tax credits I’m not sure about, I’m conservative about my business commitments and contracts.

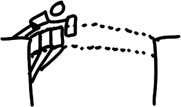

If it looks like I’ve come far, it’s only because I go one small step at a time. It’s… kinda like the builders in Lemmings, building steps until you get to where you want to go? =) And then other people can go up those steps and reach their goals more easily, or be inspired and build steps of their own.

(screenshot from http://tomato17.tripod.com/gameroom/fun07.html)

Related posts I think you might like:

Good luck!

(Hah, my current hack for coming up with blog post titles is to just squish many potential titles together. Sorry. Maybe you can give me feedback on which sub-title you liked most!  )

)

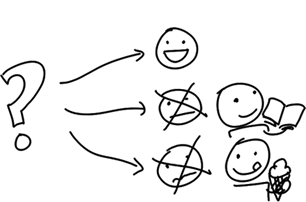

If I don’t care about the outcome of a decision – if multiple alternatives are not significantly different in terms of their value to me – I’ll tell people I don’t care strongly enough to decide. That way, they don’t mistake a casual opinion for a strongly-held opinion and end up regretting being overruled. If people really want me to participate, I’ll support whatever people suggest, and I’ll help people remember their reasons for or against something. I’ll also ask questions to draw out reasons and make off-the-wall suggestions to add humour.

If I don’t care about the outcome of a decision – if multiple alternatives are not significantly different in terms of their value to me – I’ll tell people I don’t care strongly enough to decide. That way, they don’t mistake a casual opinion for a strongly-held opinion and end up regretting being overruled. If people really want me to participate, I’ll support whatever people suggest, and I’ll help people remember their reasons for or against something. I’ll also ask questions to draw out reasons and make off-the-wall suggestions to add humour.